How I Spotted the Warning Signs Before My Debt Blew Up

I didn’t see it coming—until I was drowning. What started as manageable payments turned into sleepless nights and mounting stress. Looking back, the red flags were there all along. A few missed due dates, a growing reliance on credit cards, and an uncomfortable habit of avoiding my bank statements—each was a whisper of trouble ahead. I told myself I was just going through a tight patch. But tight patches don’t last for months. In this article, I’ll walk you through the subtle but critical signs I missed, the real-life moments that opened my eyes, and the practical steps I took to regain control. If you’ve ever felt your finances slipping, this is for you.

The Moment Everything Changed

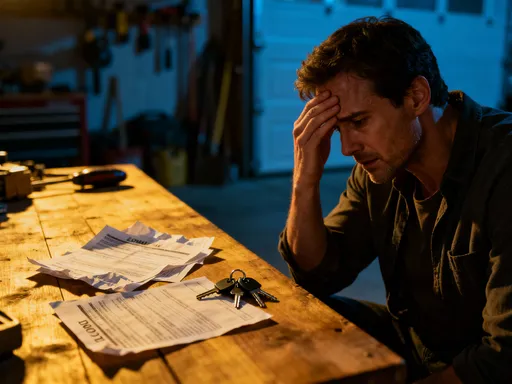

The unraveling began not with a crisis, but with a routine. It was mid-October when I first noticed I couldn’t cover my credit card bill without pulling from my grocery budget. At first, I dismissed it as an anomaly—holiday shopping started early, my car needed new tires, and my daughter’s school required a few unexpected supplies. But the following month, the same thing happened. Then the next. What had been a temporary fix became a pattern: shifting money from one essential to cover another, like playing financial whack-a-mole. The true turning point came when I received a notice from my credit issuer—my utilization rate had climbed to 89 percent, and my interest rate had increased as a result. That letter wasn’t just a warning from the bank. It was a mirror.

What struck me most wasn’t the number on the page, but the emotional weight behind it. I had always considered myself financially responsible. I paid bills on time, avoided payday loans, and never missed a mortgage payment. Yet here I was, one missed paycheck away from default. The psychological denial that had shielded me for months finally cracked. I realized I had been treating symptoms—late fees, balance transfers, minimum payments—without addressing the root cause. Like many people, I believed that as long as I wasn’t technically in default, I was safe. But financial health isn’t measured by survival. It’s measured by resilience. And mine was failing.

The truth is, most people don’t fall into debt overnight. It happens gradually, through a series of small decisions that seem harmless in isolation. The extra takeout meal charged to the card. The subscription renewal you forgot to cancel. The ‘buy now, pay later’ offer on a new sofa. Individually, these are minor. Collectively, they create pressure. And when an unexpected expense hits—a medical bill, a home repair, a job loss—that pressure becomes unbearable. I learned the hard way that financial danger isn’t always loud. Often, it’s silent, creeping in through habits so normalized we don’t see them as risks at all.

What Debt Risk Really Looks Like (Beyond the Numbers)

When we think of debt risk, most of us picture high interest rates or overdue notices. But the real danger lies deeper—in instability, unpredictability, and the fragile balance between income and obligation. Financial risk isn’t just about how much you owe. It’s about how vulnerable you are when life changes. A $5,000 credit card balance might be manageable for someone with stable income, emergency savings, and low fixed expenses. For someone living paycheck to paycheck, that same balance can be a ticking clock.

One of the most overlooked aspects of debt risk is lifestyle inflation. This occurs when your spending rises to match your income, leaving little room for setbacks. You get a raise, so you upgrade your car. You receive a bonus, so you remodel the kitchen. These aren’t irresponsible choices on their own. But when they eliminate financial flexibility, they become liabilities. I fell into this trap after a promotion five years ago. My salary increased by 25 percent, and within a year, my monthly outflows rose nearly as much. I didn’t feel richer—I just felt busier managing payments. When my hours were reduced at work due to company restructuring, I had no buffer. My lifestyle had outpaced my resilience.

Another critical factor is overreliance on credit as a normal part of budgeting. Many people use credit cards not for emergencies, but as a standard payment method, assuming they’ll pay it off each month. But when income fluctuates—due to seasonal work, freelance gaps, or part-time hours—this strategy collapses. I used to tell myself I wasn’t carrying a balance because I paid my statement in full. But some months, that payment came from draining my savings or delaying other bills. That wasn’t responsible credit use. It was a short-term illusion of control.

Real-world events expose these weaknesses quickly. A medical emergency, even with insurance, can generate thousands in out-of-pocket costs. A family member’s need for care might require reduced work hours. A natural disaster could mean unexpected home repairs. These aren’t rare extremes. They’re common life events. And if your finances are already stretched, they become financial breaking points. The numbers on a balance sheet tell part of the story. But the full picture includes your ability to absorb shocks—your true financial margin for error.

The Silent Triggers No One Talks About

While missed payments and high balances are visible signs of trouble, the real triggers often hide in plain sight. Emotional spending, social pressure, and identity-driven purchases quietly erode financial stability, masked by the appearance of normalcy. These behaviors don’t come with warning labels. They come with receipts for things that feel justified at the time—new clothes to boost confidence, dining out to celebrate small wins, gifts to show love. But over time, they create a pattern of spending that isn’t aligned with income or long-term goals.

One of the most insidious habits I developed was using rewards credit cards for everything. On the surface, it seemed smart—I earned cash back, free travel, and bonus points. But the psychology behind it was dangerous. The promise of rewards subtly encouraged more spending. I’d choose a more expensive restaurant because it offered higher cash back. I’d delay paying in cash just to maximize points. The card wasn’t a tool. It became a motivator. And when the rewards stopped feeling like a bonus and started feeling like an entitlement, I knew something was wrong.

Social pressure also played a larger role than I admitted. Saying no to school fundraisers, birthday parties, or family vacations felt like failing as a parent or partner. I didn’t want my kids to feel deprived, or my friends to think I was struggling. So I stretched my budget to keep up, often charging expenses I couldn’t afford. These weren’t reckless splurges. They were acts of care, disguised as consumption. But every ‘small’ purchase added to the strain. The real cost wasn’t the dollar amount. It was the cumulative effect of never setting a firm boundary.

Cognitive biases further distorted my perception of risk. The ‘normalcy bias’ made me believe that because I hadn’t faced a major crisis yet, I probably wouldn’t. The ‘optimism bias’ led me to assume that any financial shortfall would be temporary, and that I’d catch up soon. And ‘loss aversion’ made me more afraid of cutting back than of accumulating debt—because reducing spending felt like a loss, while debt felt abstract, distant. These mental shortcuts made it easy to ignore warning signs. They didn’t scream. They whispered, and I chose to listen to the more comforting voice.

Early Detection: Tools That Actually Work

Recognizing the problem was only the first step. The real change came when I started tracking my financial reality with honesty and consistency. I began with a simple cash flow tracker—a spreadsheet that listed every dollar coming in and going out. For the first time, I saw not just what I spent, but when and why. The patterns were revealing. I spent more on weekends. I charged more in the first week of the month, right after payday, as if I had more room in my budget. And certain categories—dining, entertainment, online shopping—were consistently higher than I remembered.

Tracking alone wasn’t enough. I needed context. That’s when I started calculating my debt-to-income ratio—a basic but powerful metric that compares monthly debt payments to monthly income. Financial advisors often suggest keeping this below 36 percent for stability. Mine was over 52 percent. That number shocked me. It meant more than half of my take-home pay was committed to debt service before I even covered groceries, utilities, or transportation. This wasn’t just a budget issue. It was a structural risk.

I also conducted a spending pattern audit, reviewing six months of bank and credit card statements. I categorized every transaction and looked for trends. What I found was a series of ‘leaks’—small, recurring expenses that added up silently. Streaming services I rarely used. Memberships I forgot to cancel. Automatic renewals for software and apps. Individually, each was under $20. Together, they totaled over $150 a month—nearly $1,800 a year. That was enough to cover an emergency car repair or build a meaningful savings cushion.

The tools I used were simple: my bank’s mobile app for real-time balance updates, a free budgeting spreadsheet, and calendar reminders to review my finances weekly. I set up alerts for when my account dipped below a certain threshold and when bills were due. These weren’t high-tech solutions. But they created accountability. The most important part was consistency. I committed to reviewing my finances every Sunday evening, no matter how busy the week had been. That routine turned awareness into action. Over time, I began to spot red flags before they became emergencies—like a rise in credit card usage or a dip in savings. Early detection wasn’t about predicting the future. It was about seeing the present clearly.

When Income Isn’t the Problem—But Risk Is

One of the most dangerous financial myths is that a stable income equals financial safety. I believed this for years. I had a full-time job, steady paychecks, and benefits. On paper, I was secure. But security isn’t just about income. It’s about sustainability. And sustainability depends on more than your salary—it depends on your exposure to risk.

I was overconfident in my job security. I had been with the same company for over a decade and assumed that loyalty would protect me. But industries change. Companies downsize. Roles become automated. When a restructuring eliminated my position, I wasn’t fired for poor performance. I was replaced by a streamlined process. The severance helped, but it wasn’t enough to cover my existing obligations without dipping into credit. That’s when I realized: high income without a buffer is high risk.

Another vulnerability was single-income dependence. My household relied on one primary paycheck, with no secondary earner or side income. That made us extremely sensitive to any disruption. Even a temporary reduction in hours could trigger a chain reaction. I met others in similar situations—teachers, nurses, office workers—who assumed their jobs were safe because they served essential functions. But essential doesn’t mean immune. Budget cuts, outsourcing, and technological shifts affect every sector.

Systemic economic factors also played a role. Inflation eroded purchasing power, making fixed incomes stretch thinner. Interest rate hikes increased borrowing costs, especially for variable-rate debt. And the rising cost of healthcare, education, and housing meant that even with a good salary, families were spending more on necessities. I had focused so much on earning more that I neglected to protect what I had. Financial safety isn’t just about how much you make. It’s about how well you can withstand the unexpected. And without emergency savings, diversified income, or a low-debt structure, even high earners can be one step from crisis.

Building Your Personal Risk Radar

After my wake-up call, I knew I needed more than a budget. I needed a system—a personal risk radar that could detect trouble before it escalated. I started by categorizing my debts based on three factors: urgency, interest rate, and flexibility. High-priority debts included those with high interest and rigid payment terms, like credit cards and personal loans. Medium-priority were obligations with lower rates but less flexibility, such as my auto loan. Low-priority was my mortgage, which had a fixed rate and long-term structure.

Next, I integrated emergency planning into my monthly routine. I calculated three months of essential expenses—rent, utilities, food, insurance, minimum debt payments—and set that as my initial savings goal. I automated a small transfer to a separate account each payday. It wasn’t much at first, but it built momentum. I also conducted liquidity checks—ensuring I had enough accessible cash to cover a surprise expense without relying on credit. This meant keeping a portion of savings in a high-yield account, not tied up in investments or retirement funds.

I began stress-testing my budget, imagining different scenarios: What if my income dropped by 30 percent? What if I had a medical emergency? What if I needed to support a family member? For each, I adjusted my spending and assessed whether I could maintain minimum obligations. This exercise revealed gaps I hadn’t seen before. It also helped me prioritize debt reduction—not just to save on interest, but to increase flexibility.

One real example was when I considered switching to part-time work to spend more time with aging parents. Before, I would have assumed it was impossible. But with my new risk radar in place, I modeled the change. I reduced discretionary spending, paused non-essential subscriptions, and accelerated debt payoff on my highest-interest card. The result? I found I could make the transition without financial collapse. That sense of control was empowering. A personal risk radar doesn’t eliminate uncertainty. But it turns fear into preparation.

From Awareness to Action: Staying Ahead of the Curve

Understanding the warning signs was important. But real change came only when I moved from awareness to action. I started by prioritizing high-risk debts, focusing first on the credit card with the highest interest rate. I called the issuer to negotiate a lower rate and transferred the balance to a card with a 0 percent introductory APR. I committed to paying it off within the promotional period and avoided adding new charges. This single step saved me hundreds in interest and reduced my monthly pressure.

I also created exit plans for each debt—clear, measurable goals for when and how I would eliminate it. For my auto loan, I decided to keep the car longer than planned and apply any extra funds toward the principal. For medical bills, I set up a payment plan with no interest and treated it like a fixed expense. These weren’t drastic measures. They were deliberate choices to regain control.

The deeper shift was in my mindset. I moved from reacting to crises to proactively managing risk. I stopped viewing my budget as a restriction and started seeing it as a strategy. I celebrated small wins—paying off a card, hitting a savings milestone, avoiding an impulse buy—not with rewards, but with recognition. This new approach wasn’t about perfection. It was about progress.

Today, I still monitor my finances weekly. I still track my debt-to-income ratio. I still stress-test my budget. These habits are no longer temporary fixes. They are part of how I live. The goal isn’t to avoid all risk—because life will always have uncertainty. The goal is to build resilience, so that when challenges come, I’m not caught off guard. Financial peace isn’t found in never having debt. It’s found in knowing you can handle it. And that comes not from luck, but from vigilance, preparation, and the courage to face the truth before it’s too late.